The 1999 Dept.

of Justice/IRS Court Case

United States v. Ed Hedemann

The Hearing and Anti-Militarism Demonstration: On March 5, 1999, we staged a walk through downtown Brooklyn, including leafleting and picketing in front of the Army, Navy, and Marines recruiters offices and the IRS building before a walking through the shopping area to the municipal, state, and federal court area of Brooklyn (about a mile altogether). We arrived at the Federal courthouse for the U.S. v. Hedemann hearing. (Click here to see a fuller report with photos.)

Summary: The Internal Revenue Service wants the federal court to force Ed Hedemann to turn over all his financial papers to the IRS thus allowing them seize Hedemann's assets in order to pay for the federal income taxes that Hedemann—as a conscientious war tax resister and pacifist—has redirected away from the IRS and the military to private organizations and projects seeking to improve people's lives.

Background: Since 1972 Ed Hedemann has refused to pay federal income taxes and (since 1970) the federal excise tax on telephone service (which was levied initially to pay for the Vietnam War) as a protest to the military and war spending of the U.S. government. During this period most (50 to 65 percent) of the federal individual income tax has been spent on past and present military programs through the Department of Defense and related departments and agencies (see War Resisters League's analysis).

Though Hedemann fills out and files his tax returns normally (including paying state, local, and social security taxes), he redirects the entire portion of his federal income tax away from the IRS to organizations working to improve the lives of all people. Hedemann recognizes that there are some expenditures of the federal government that are beneficial to people, but he realizes that any portion of the federal income tax that he sends to the IRS will be spent in large part on the military. Consequently, he sends none of it to the IRS. Every year he includes a letter with his return explaining what he is doing and why.

Among the organizations to which Hedemann has recently redirected his federal income tax money include Voices in the Wilderness (which provides aid to Iraqi civilians suffering under the U.S.-sponsored embargo), the New York Times’ "Neediest" cases fund, the War Resisters League, a documentary film on the 1990 murders of the Jesuit priests in El Salvador, and the NYC People’s Life Fund.

In response, the IRS has routinely sent threatening letters, made phone calls, visited his apartment, gone to his employers or clients with levies, and delivered liens to the registrar’s office of his county, all in an effort to attempt collection or force Hedemann to stop his war tax resistance and settle with the IRS.

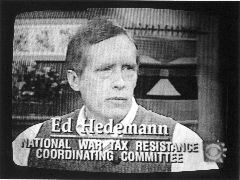

Over the years Hedemann has given workshops on war tax resistance, appeared on radio and television tax shows, and in 1981, he wrote Guide to War Tax Resistance, published by the War Resisters League and now in its fourth edition. But it was shortly after his appearance on "CBS This Morning" in April 1995 as a representative of the National War Tax Resistance Coordinating Committee that the IRS increased their efforts against Hedemann including a demand to one client (in early 1996) that he be fired.

|

Ed Hedemann discussing war tax resistance on "CBS This Morning," April 17, 1995. |

Presumably because these efforts were unsuccessful in collecting any money or stopping Hedemann’s redirection of federal income taxes away from the IRS, in December 1997 the IRS issued a summons for Hedemann to appear in their Brooklyn office "to give testimony and to bring for examination ... all documents and records ... regarding assets, liabilities, or accounts ... [including] bank statements, checkbooks, canceled checks, savings account passbooks ... vehicle registration certificates, deeds..., life and health insurance policies."

Hedemann appeared at the IRS building on January 28, 1998, but only produced the War Resisters League’s Where Your Income Tax Money Really Goes tax piechart, which shows how U.S. federal income tax dollars are spent largely on the military. During the interview with the IRS agent, Hedemann explained that he could not turn over the records they sought because they could use these records to seize assets, which in turn would be used for military spending and killing people. As a pacifist he stated that he was morally and politically opposed to spending money which would kill or threaten to kill people. After about five minutes, the IRS agent terminated the interview.

In February of 1998 another summons (this time from the district counsel of the IRS) was served directing Hedemann to appear before the same IRS agent to produce the same records. The March 5, 1998, meeting ended with the same result as the previous interview.

Then on December 11, 1998, two IRS agents delivered an "order to show cause" for Hedemann to appear in U.S. District Court (in Brooklyn) on December 30 to explain why he "should not be compelled to testify and produce the books ... demanded in the IRS summons...." Hedemann was given until December 21 to file a written response. Judge Carol Amon granted Hedemann an extension until January 21 for a written response and February 1 for the court hearing. (See previous cases of war tax resisters who have ordered to appear in court.)

Hedemann's January 21 response raised four defenses: 1) turning over financial records would facilitate collection of money for the military to which Hedemann is morally opposed, 2) the taxes have already been paid—to private organizations, not to the IRS, 3) turning over records may provide the IRS with information with which to criminally prosecute Hedemann (the Fifth Amendment), and 4) this government effort is selective enforcement—because the IRS rarely resorts to Federal court in these kinds of cases. In addition, Hedemann asked for $80 in "witness fees" the IRS is supposed to pay for his appearances in response to the two summons.

On January 26, 1999, five days later, the U.S. attorney's office requested a postponement of the case "because the Government needs additional time to prepare a response to the issues raised in Defendant's opposition." Judge Carol Amon granted that extension rescheduling the hearing to March 5, 1999. On March 1 the government issued its response to Hedemann's January 21 brief basically saying that Hedemann used the Fifth improperly. He should have asserted the Fifth to every question asked by the IRS rather than invoking the Fifth in a "blanket" fashion. As to the other defenses, the government characterized them as "irrelevant," "immaterial," "not proper," "not supported by facts," "besides the point," etc. As to the witness fees, the government said it was "premature" since Hedemann had not complied with the summons.

On March 5, 1999, Judge Carol Amon grilled U.S. Attorney Sandra Levy about the government's objections to Hedemann's use of the Fifth amendment. In the end, the judge asked Hedemann to show up once more at the IRS to respond to the IRS questions, citing the Fifth where he felt appropriate. So, on March 8, 1999, Ed and four others met with three IRS collection agents. Giving only his name, address, telephone, and social security number (which are all on his tax returns), Ed refused to answer the series of financial questions because of "the posssible danger of self-incrimination." The interview, which lasted about 20 minutes, was polite and pretty stupid. As a parting gesture, Ed gave the IRS agent the 1999 version of WRL's "Where Your Income Tax Money Really Goes" piechart.

The next move is now up to the government.